Bloggers’ income and traffic reports are everywhere. In the past few years, talking about what exactly bloggers are earning has gone from being taboo or vague to being open and transparent (providing that you’re doing well already!).

If you’re like me, bloggers’ accounts of their successes and failures are fascinating and addictive to read and try and learn from. I first came across Pat Flynn’s Smart Passive Income blog and I really like how he talks at length about the lessons he learnt each month, his milestones, things that didn’t go to plan and things he’s working on next. More recently, I’ve had other food bloggers contacting me about Pinch of Yum’s income reports as they try to emulate their earnings.

For those bloggers that do publish their income reports, they eliminate the guesswork by readers on how a blogger is monetizing their blog; no more hunting around in the source code to see the ad networks or affiliate schemes as every source of revenue is laid out line by line with the amount earned from it that month. And, on the expenses side, I love seeing the different tools and apps and services that bloggers are spending money on to be more efficient and to run their business.

The formula is like this: each month, add up all the income sources and then subtract the expenses which are listed and come up with one figure at the end which is labelled “Net total” or “Net Profit”. Some bloggers don’t include their expenses, and simply list their total income for the month.

But here’s the thing: even if their reports are totally accurate and transparent and are listing all their income and business expenses, the reports are missing a big piece of the full financial picture.

Now, none of them are saying that their “bottom line” report is a full financial picture of their blogging business, but when you see headlines like “How I made $25,000 blogging last month!” it’s easy to fall into the trap of being envious, feeling like a failure, or dreaming of how life would be life if you had done the same — without clearly thinking about all the things that their reports aren’t telling you.

#1: Real business expenses

These things might not be very exciting or sexy to write about but most likely add up to be more than the typically listed expenses. These include rent (even if working from home, I can claim a percentage of my mortgage interest as business rent), power, phone, internet, gas, stationery, taxes and any business insurance.

#2: Debt

Being a blogging entrepreneur is hard work. I honestly don’t know of anyone who does it and hasn’t had times where they’ve struggled with income problems due to a variety of factors. For example: not enough traffic, a sudden drop in traffic from a particular source, search engine penalties, temporary or permanent loss of an ad channel (e.g. Google Adsense pausing your income while your site has content which breaks their terms), broken or hijacked ad code, changing ad networks and revenue fluctuating, affiliate programs drying up, hosting outages, social media changes, competition from other websites and so on. What’s more, ad networks can take many months to send through payments.

Can you believe how many different factors I listed there off the top of my head? Being a blogger is stressful; one’s job doesn’t ever really go into total cruise mode. The game is always being changed and upped.

Bloggers may have had long periods where they’ve been making a loss, but they’re passionate about their dream and are working hard hustling their way to success. They most likely don’t want to go back to working for someone else.

But, before they started publishing their income reports, were they building up significant debt? Is a lot of their income going to service this debt? While it’s not really our business to know the full financial health of the bloggers who are publishing this information, it could be giving a really misleading picture as to what’s going on. It could be years before they’re truly in the black.

#3: Hours

I’d love to see exactly how many hours the bloggers are putting into their businesses each month. The four-hour working week talk, carefully designed Instagram feeds of beautiful fun lives and all the talk about the freedom to spend lots of time with family can often lead to the impression that blogging is easy money once you’ve made it to a certain level. I have yet to meet anyone like this.

Bloggers are living, breathing, dreaming and thinking about their business all the time and putting in crazy hard hours to make it all happen. They’re getting up before everyone else in the household does to schedule content, working late into the evening and everything in-between. It’s never ending – their job does not end on the weekends and typically gets more crucial at those key holiday times during the year. Consider food bloggers – their blogs are most visited just prior to Thanksgiving, Christmas and other big celebrations, right when they have their own family commitments to attend to as well.

#4: Salary

How much does the blogger themselves actually “take home” or pay themselves at the end of the day? Are they living it up, keeping to a strict budget, saving hard or investing in their business? What do they need to pay for their personal expenses each month?

Again, while this is not our business and there’s no need for a blogger to reveal this, it is really hard to know if earning $25,000 in a month is an amazing thing or not when they may only be paying themselves a small amount to live on and the rest is going on expenses, debt and savings.

The full picture

Income reports are a fun, fascinating insight into someone else’s world. But it’s not a clear picture of what’s really going on. I challenge those who are publishing these types of reports to consider expanding them out to tell us more of the story of their business expenses, their debt and hours they (and their family!) put into the business.

I’d also love to see their break-even amounts – what they need to earn each month to pay all their personal and business expenses.

I’ve been thinking about this topic a lot as I read through Dianna Huff’s upcoming step-by-step guide to finally sorting out your finances as a freelancer: Cash Flow for Freelancers.

There is so much talk about income, but very little about managing cash flow and all its ups and downs.

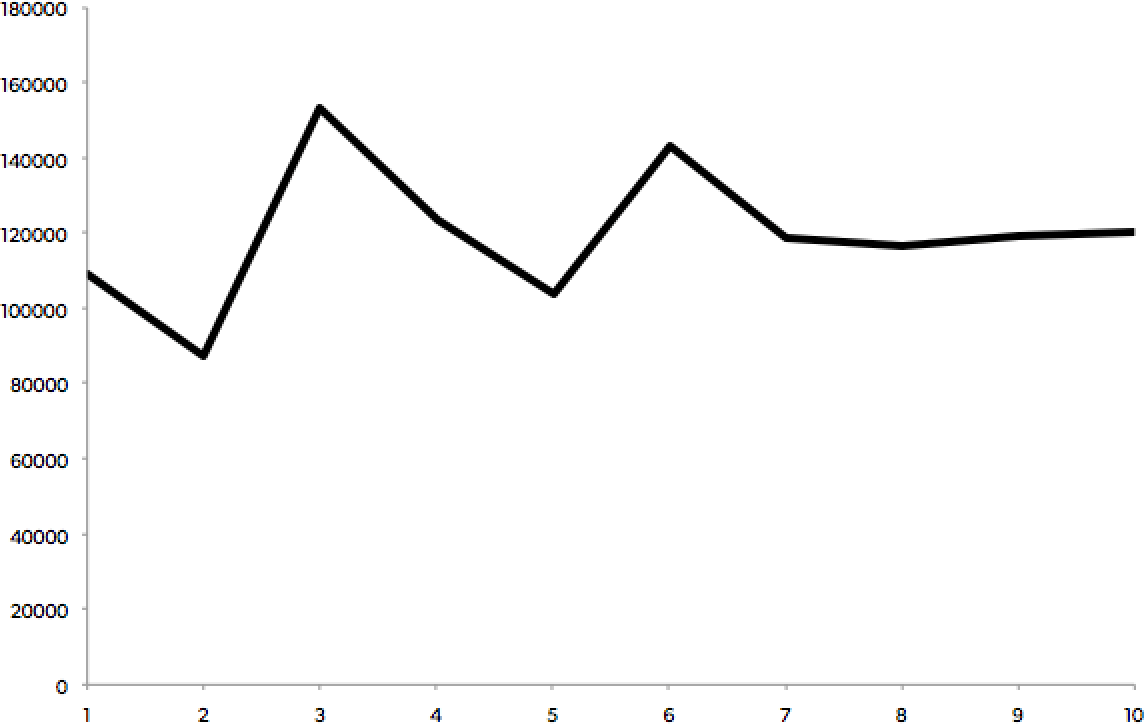

For example, take a look at Pat Flynn’s net total for 2015. His best month (March) is 75% more than his lowest (February):

On Pinch of Yum this year, July is 124% net total more than January:

Even on wildly successful blogs, income fluctuates. Figuring out to manage fluctuations is no different if you’re earning $20,000 a month or $2,000 a month.

Cash Flow for Freelancers

That’s why I am so proud of Dianna Huff’s work on Cash Flow for Freelancers. Her work takes you step-by-step through a process of exercises to help you figure out exactly where all your month is going and what you need to make to break even. Instead of obsessing about other people’s earning reports, going through her process of figuring out where YOU stand financially is crucial.

The guide is now available for purchase.

What are your thoughts on blogger income reports?

Let me know in the comments! Do you find them helpful to learn from?

Get actionable tips to grow your website

Thoughtful weekly insights (no hype!) on improving your website